Decanting a trust is a novel and increasingly popular approach to altering an irrevocable trust. But what exactly does it entail?

At Massingill, we pride ourselves on bringing clarity to all kinds of estate matters. We especially enjoy unraveling particularly complex topics like trust decanting.

If you want to learn more about decanting a trust, then you’ll want to read this article. We’ll demystify trust decanting and delve into its workings in the State of Texas. We’ll also explore the reasons someone might consider this approach.

Whether you’re a trustee or just someone curious about the issue, you’ll have valuable knowledge after reading our guide. Contact us if you have questions about decanting a trust or a specific trust situation.

What Is Trust Decanting?

Decanting refers to transferring trust property to another trust under the trustee’s discretionary authority to benefit one or more beneficiaries.

Situations often arise where the terms of an original trust no longer align with the beneficiaries’ current needs or best interests.

Perhaps the original terms are too restrictive. Or maybe the terms provide inadequate protection against creditors.

Under these scenarios, you may need to make alterations to the irrevocable trust. At the same time, you want to accomplish these changes without going through a lengthy and costly court process.

Trust decanting can be the solution to this Gordian knot. Decanting a trust refers to transferring assets from one irrevocable trust to another in order to update the terms of the original trust. This process allows for modifications to be made, similar to how decanting separates wine from sediment.

The main reason for decanting a trust is to take advantage of the new trust’s terms, which often better suit current circumstances. With this tool, a trustee can “pour” the assets from the first trust into a second one while making desired modifications to the trust terms.

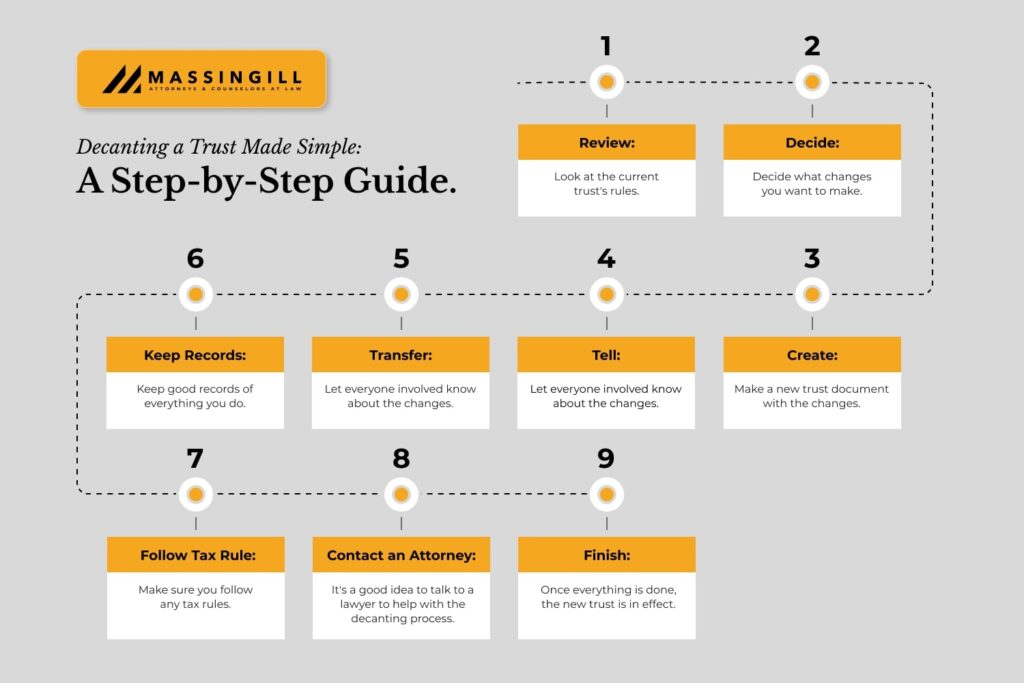

How Do I Decant a Trust?

While the concept might seem simple, state-specific rules and regulations dictate trust decanting. In Texas, the Trust Code provides guidelines and conditions for permissible decanting.

Decanting a trust in Texas involves following a structured process and adhering to specific regulations outlined in the Trust Code. Let’s unpack this path in more detail.

Preparing to Decant a Trust

As with most other actions in estate law, planning is crucial. Begin by determining if you can decant the trust. Not all trusts are eligible for decanting. Texas law requires that the trust be either an irrevocable inter vivos or testamentary trust.

An inter vivos (or “among the living” trust) differs from a testamentary trust primarily in its origins, where the trust comes into effect while the trust’s creator (or settlor) is still alive. On the other hand, a testamentary trust comes into effect upon the settlor’s death.

You need to satisfy two conditions. First, the original trust document must not explicitly prohibit decanting. Second, the trustee must also possess the discretionary power to distribute the original trust’s principal on behalf of the beneficiaries.

Texas law considers you an authorized trustee with unlimited discretion if you have this power. If you are a trustee with limited discretion, you will encounter various limitations on your ability to customize the new trust.

For instance, you won’t be able to alter which one of the beneficiaries receives property from the new trust. However, a trustee with unlimited discretion can direct the trust’s assets to any or all of the original trust’s beneficiaries.

Once you navigate past these preliminary considerations, assess the best interests of the beneficiaries. Texas law requires that any decanting action be in the best interests of the beneficiaries. This requirement guarantees their welfare remains paramount throughout the process.

Assuming trust decanting will benefit the beneficiaries, begin designing the second trust. As the trustee, you or your legal representative must draft a new trust (the second trust) that provides the necessary changes. While certain modifications are permissible, there are restrictions.

Making the Trust Decanting Reality

Once you have a valid second trust ready, notify all interested parties. The Texas Trust Code mandates that you provide notice of the intention to decant to certain interested individuals, including all current and presumptive remainder beneficiaries.

Notification allows beneficiaries to object to the decantation. After giving notice, you must wait for a specific time (usually 30 days) to allow other parties to raise concerns or voice objections. If an interested party objects, you may have to litigate the issue in state court.

If no party objects to the proposed transfer, you can formally “pour” the assets from the original trust into the newly created trust. When you do so, keep a thorough record of every action taken.

Include details such as the rationale behind decanting and the specifics of the changes. This documentation serves as evidence that you acted prudently and in the best interest of the beneficiaries.

In essence, trust decanting in Texas is a powerful tool. Nonetheless, it requires a careful and knowledgeable approach to ensure compliance with the law and protect beneficiaries’ best interests.

The Role of a Texas Estate Attorney

As you can see, decanting a trust is a strenuous endeavor. Hiring a Texas estate attorney improves your chances of obtaining an ideal outcome by helping you with every step of the decanting process. Their services include:

- Assessing suitability. Before embarking on decanting, an attorney can review the original trust document to ascertain if decanting is feasible and beneficial. They’ll evaluate the trust’s terms, the trustee’s powers, and the current circumstances to determine if decanting aligns with the best interests of the beneficiaries.

- Interpreting Texas law. The provisions governing trust decanting in Texas are both complicated and intricate. A skilled estate attorney can interpret and apply the nuances of these laws to help guarantee your full compliance with state regulations.

- Drafting the second trust. Creating a new trust document that captures the desired changes while still adhering to Texas law is vital. An experienced estate attorney can craft a document that effectively addresses the beneficiaries’ needs.

- Managing objections. Estate matters are often highly emotional, so it’s quite possible beneficiaries or other interested parties will raise concerns or objections. If that happens, a local estate attorney can provide mediation, offer solutions, and help keep the decanting process compliant and fair.

- Risk mitigation. Decanting can carry potential risks, including tax implications or unintended loss of asset protection. An attorney can identify these risks early on and provide strategies to mitigate them.

- Documentation and record keeping. Proper documentation is essential not just for legal compliance but also for your future reference. An attorney will oversee the documentation process to clearly indicate each step taken, every decision made, and all applicable rationales.

Finally, an attorney can help you with any post-decanting actions. These actions commonly include updating financial institutions about the new trust and verifying that all assets have correct titles.

Call (512) 410-0343 or contact us online to speak with our estate planning attorneys

Trust decanting is no ordinary legal matter. It’s a cutting-edge estate law strategy that can be a game-changer if successful. But it can also lead to litigation if not handled well. Therefore, partner with the right legal team to maximize your chances of triumph.

At Massingill, our primary goal is to simplify complicated parts of the law. We understand the incredible trust our clients put in us to help them manage their legacy, and we take that obligation seriously.

Our team is passionate about ensuring every step you take aligns with the spirit and the letter of the law. We also prioritize accessibility and outstanding client service. Don’t believe us? Visit us online to view our countless positive testimonials from former clients.

Then call us or book a consultation online.

Where You Can Find Our Austin Offices

Where You Can Find Our Abilene Office