If you die without a will in Texas, any property you own at the time of your death will be distributed in accordance with Texas intestate succession laws. But, you may be wondering, What exactly does that mean?

If you have questions about how to plan for your future and what happens if you die without a will in Texas, you are not alone. These are thoughts that people frequently have.

Use our guide below to learn more about the consequences of dying without a will and how the attorneys at Massingill can help you protect your rights, interests, and family into the future.

If you have questions, please contact us today.

Dying Without a Will in Texas: An Overview

If you die without a will in Texas, it can lead to several complications for your estate and family after your passing. Here are a few things you should know about the implications of dying without a will.

First Things First: What Is a Will

Before discussing what happens if someone dies without a will in Texas, it’s important to have a basic understanding of what a will is.

A last will and testament, commonly referred to simply as a “will,” is a legal document allowing an individual to outline specific wishes that will take effect after death. Wills frequently address topics such as:

- Asset distribution,

- Gifts and bequests of specific personal property items,

- Appointment of an executor who will manage the estate,

- Guardianship for minor children, and

- Funeral and burial wishes.

Notably, a valid will is a legally binding document that will be effective even after you have passed away.

Probate Process, Generally

When someone passes away in Texas, their estate may need to be probated.

Probate is the legal procedure for settling the estate of someone who has passed away (the “decedent”) and distributing their assets to heirs, beneficiaries, and creditors.

The Texas probate process typically involves the following steps:

- Locating the decedent’s estate planning documents;

- Determining the validity of the decedent’s will, if one was left;

- Filing the application for probate;

- Determination or appointment of an executor;

- Providing notice to any interested parties of the probate proceedings;

- Identifying and valuing the decedent’s assets;

- Paying off any debts and taxes; and

- Distributing any remaining property to the decedent’s heirs and beneficiaries named in their will.

Depending on the case’s complexity and the estate’s value, a decedent’s estate may be eligible for simplified procedures. Regardless, it is crucial to comply with the legal requirements and deadlines throughout the process.

What Happens to My Property When There Is No Will in Texas

Unfortunately, not all individuals will have a valid will in place at the time of their death.

When someone dies without a will, also known as dying “intestate,” they will not have a way to specify who they wish to receive their property after death. Accordingly, the property must instead be distributed according to Texas intestate succession laws.

These laws specify the order in which property will be distributed to surviving family members. For example, suppose a decedent had a spouse at the time of their death.

In that case, their property will typically be divided in shares specified in Texas Estates Code section 201.002 among their spouse and any surviving children, parents, or siblings, if any.

However, if a decedent did not leave a spouse at the time of their death, their property will pass in the following order:

- First, to the decedent’s children and the children’s descendants, if any;

- If the decedent had no children, then to the decedent’s parents, in equal portions;

- If the decedent left only one surviving parent, then half of their property to the surviving parent and the other half to the decedent’s siblings and siblings’ descendants;

- If the decedent had no surviving parents at the time of their death, their entire estate would pass to any surviving siblings and the siblings’ children.

If the decedent left no surviving children, parents, or siblings, their estate would pass to more remote surviving relatives, such as grandparents and cousins, in order of priority under the intestate succession laws.

Finally, in rare cases where the decedent leaves no surviving descendants, their estate is subject to “escheat,” meaning that the State of Texas may take ownership of any property.

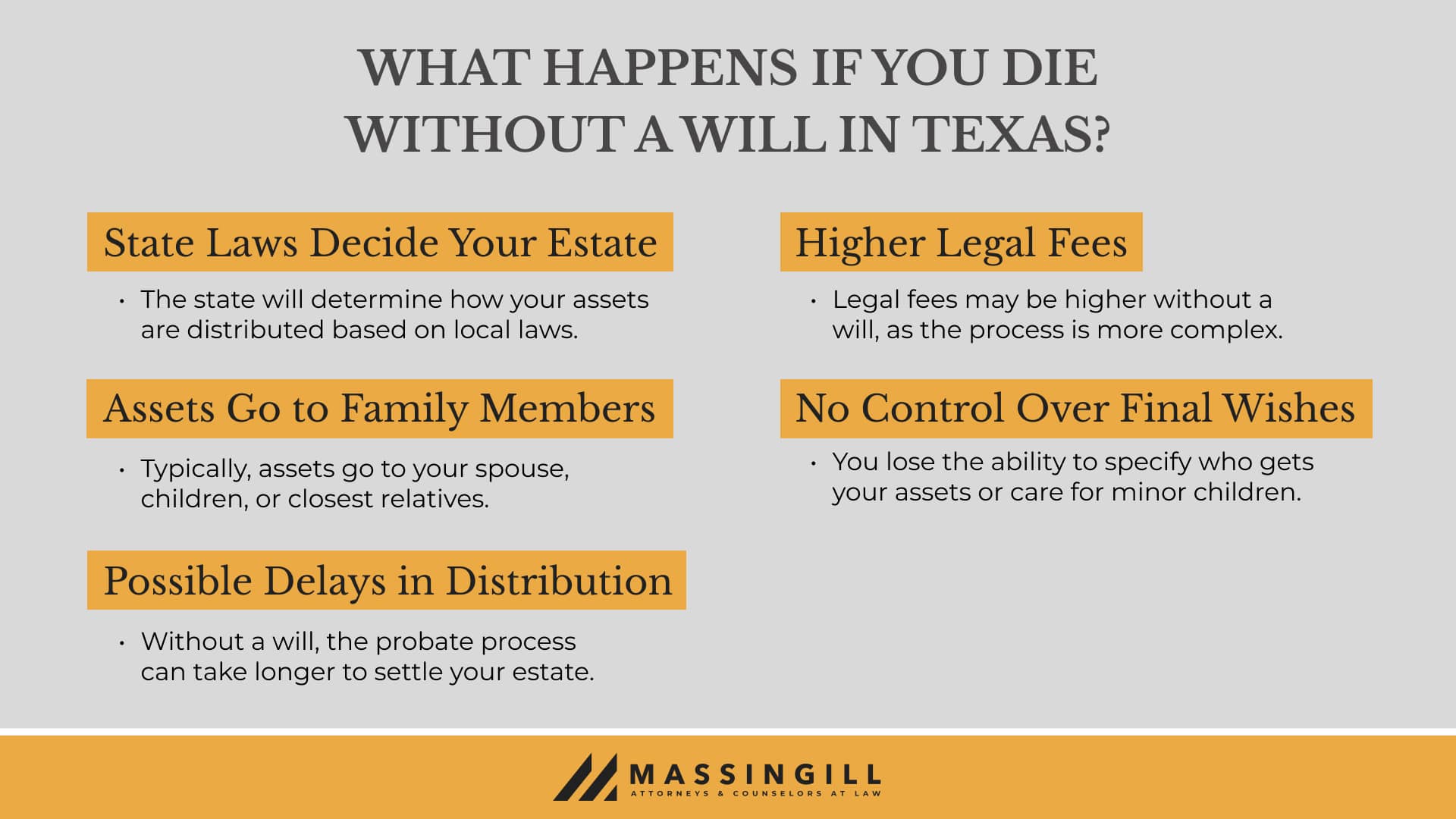

Other Consequences of Dying Without a Will in Texas

There are several disadvantages of dying intestate. Some of these potential consequences include:

- A lack of control over how your assets and property will be distributed;

- Inability to leave property to individuals or charitable organizations;

- Increased likelihood of disputes among surviving family members;

- Lengthier and more complicated probate proceedings;

- Higher expenses in court costs and legal fees, ultimately leaving less for your descendants; and

- Inability to specify guardianship designations for minor children.

One of the best ways to avoid these negative consequences and better protect your loved ones after your passing is to create a valid will. Thus, consider discussing your goals and options with an estate planning attorney.

Call (512) 410-0343 or complete the free case evaluation form below

Don’t Die Without a Will in Texas: Contact an Estate Planning Attorney for a 100% Free Consultation Today

Thinking about the future can feel scary and overwhelming for many. However, it doesn’t have to be this way.

Having a well-crafted estate plan in place can be a fantastic way to prevent uncertainty and reduce your stress and anxiety about the future, all while safeguarding your estate and protecting the rights and interests of your loved ones.

At Massingill, our attorneys know that creating an estate plan is a big step. We pride ourselves on making the complex simple.

Book a consultation online or call us today to discuss your estate planning goals and see how our team can help you create a will that meets your needs.

FAQs

Do I Have to Create a Will?

In short, no, you do not have to create a will. Texas law has default rules that govern how property will be distributed If someone dies intestate.

That said, having a will is strongly recommended, as this can allow you to plan for the future and better ensure that your property will be properly managed and distributed to your loved ones after your death.

Is a Will the Only Type of Estate Planning Document Available?

No, while a last will and testament is a great estate planning tool, it is not the only option available.

For example, many people use trusts, which allow you to continue managing your property during your lifetime and then seamlessly transfer that property to your desired beneficiaries after you have passed away.

Other types of estate planning documents frequently include powers of attorney, healthcare directives, and HIPAA waivers, all of which can help you protect yourself and your legacy for years to come.

Do I Have to Hire an Attorney to Create a Will or Other Types of Estate Planning Document?

No, you do not have to hire an attorney to create a will or any other estate planning document.

However, it’s important to note that most estate planning documents must meet certain formalities and other requirements to be valid and enforceable under Texas law.

Thus, having an experienced estate planning attorney can provide valuable insight and legal expertise to help you meet your estate planning needs and goals.

Where You Can Find Our Austin, TX Offices

Where You Can Find Our Abilene, TX Office