When someone passes away, the executor is in charge of handling the decedent’s estate.

From finding assets to paying taxes to distributing real estate, the executor has a lot to do.

Let’s walk through the different responsibilities of an executor of an estate.

If you have questions, please contact the Austin estate planning attorneys at Massingill today online or call us at 512-410-0343 to schedule a confidential case review.

What Is an Executor of a Will?

An executor, sometimes called an administrator or personal representative, is a person or entity who settles the affairs of someone’s estate after they die.

In some cases, the decedent will appoint an executor under his or her will. If there is no will or no executor is chosen under the will, the probate court will appoint an executor of the estate.

In Texas, there is both dependent and independent estate administration. The default is dependent administration, where the court has strict supervision over the probate process.

On the other hand, independent administration does not have court oversight, and the process is much simpler. With either type of administration, the executor of an estate still has the same responsibilities and fiduciary duty.

What Is the Executor’s Fiduciary Duty?

When administering the estate, the executor has a fiduciary duty to the estate, heirs, and beneficiaries. Heirs are people related to the decedent who inherits, while beneficiaries can be anyone or an entity.

Duty of Loyalty

The duty of loyalty means that the executor can act only in the best interest of the estate, heirs, and beneficiaries.

For example, the executor cannot use estate assets for their personal benefit, pay themselves unnecessarily large fees, or take a profit from business dealings with the estate.

Duty of Prudence

The duty of prudence is the obligation to act with care, diligence, and caution when administering the estate.

The executor must act as a “prudent person” would, meaning with the same care and skill that a person would use if handling their own affairs.

Duty of Preserving Estate Assets

This duty requires managing the estate assets appropriately. For example, the executor may need to get sufficient insurance coverage for certain assets and keep a separate bank account solely for money that belongs to the estate.

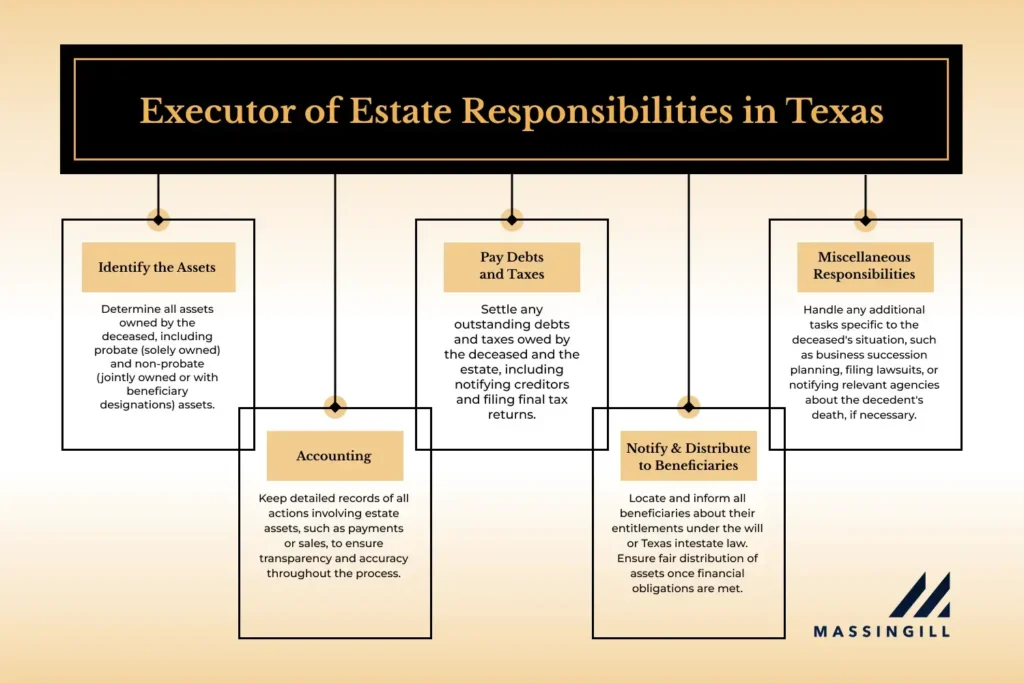

What Are the Responsibilities of the Executor of an Estate?

Once the executor receives letters from the probate court granting authority to serve as the executor, that’s when the duties and obligations kick in. The executor has responsibilities to the beneficiaries as well as the estate.

Identify the Assets

A person’s estate is basically everything they own (i.e. their assets). There are both probate and non-probate assets.

Probate assets are those titled solely in the name of the decedent, and these assets go through the probate administration process.

Non-probate assets can be anything from jointly owned property to accounts with a beneficiary designation (e.g. life insurance).

These types of assets do not go through probate because they automatically transfer to someone else once the decedent passes away.

The executor must identify all the decedent’s assets to come up with a complete picture of the estate. An accurate inventory of assets is necessary to properly transfer property and satisfy financial obligations.

An ongoing responsibility of the executor is to account for any action involving the estate assets. For example, if the estate makes a payment or sells property, the executor must keep track through what is known as accounting.

Pay Debts and Taxes

An executor of a will must pay any debts and taxes of the decedent and the estate. All creditors must be notified of the decedent’s death and given the opportunity to bring forth any legitimate claims.

The executor is responsible for filing final tax returns and paying any outstanding amounts for both the decedent and the estate. Even at death, you can’t escape taxes.

Distribute Assets

Estate assets can be distributed to heirs and beneficiaries only once all financial obligations of the estate are satisfied.

The executor of a will has the responsibility to locate and notify all beneficiaries that the estate is under administration.

Next, the executor must ensure all beneficiaries and heirs receive what they’re entitled to under the will. Not everyone leaves a will or accounts for all their assets in their will.

In that case, the remaining assets transfer to the beneficiaries according to Texas intestate law. Basically, there is a hierarchy of who gets leftover assets, starting with the decedent’s spouse, then children, then parents.

Miscellaneous Responsibilities

Ultimately, the executor must do whatever is necessary to wind up the decedent’s life. However, since all estates are unique, there are some responsibilities that one executor may have that others will not.

For instance, if the decedent was a business owner, there may be very strict steps to take as part of the succession plan for the company.

Here are some other examples:

- File a wrongful death lawsuit;

- Notify the Social Security Administration or state agency of the decedent’s death, if receiving benefits; and

- Finalize any pending lawsuits involving the decedent.

These responsibilities are tricky to navigate, so contact Massingill if you need assistance.

What Can an Executor Not Do?

As an Executor, what you cannot do is go against the terms of the Will, Breach Fiduciary duty, fail to act, self-deal, embezzle, intentionally or unintentionally through neglect harm the estate, and cannot do threats to beneficiaries and heirs.

Talk with One of Our Estate Planning Attorneys Today

Whether you’re the executor or beneficiary of an estate in Texas, we’re here to help.

Our estate planning attorneys can answer your questions and guide you through the estate administration process.

Through a personalized approach and ongoing communication with our clients, we continually earn five–star Google ratings.

Contact us today online or call us at 512-410-0343 to schedule a consultation.